++ 50 ++ yield curve recession chart 201123-Inverted yield curve recession chart

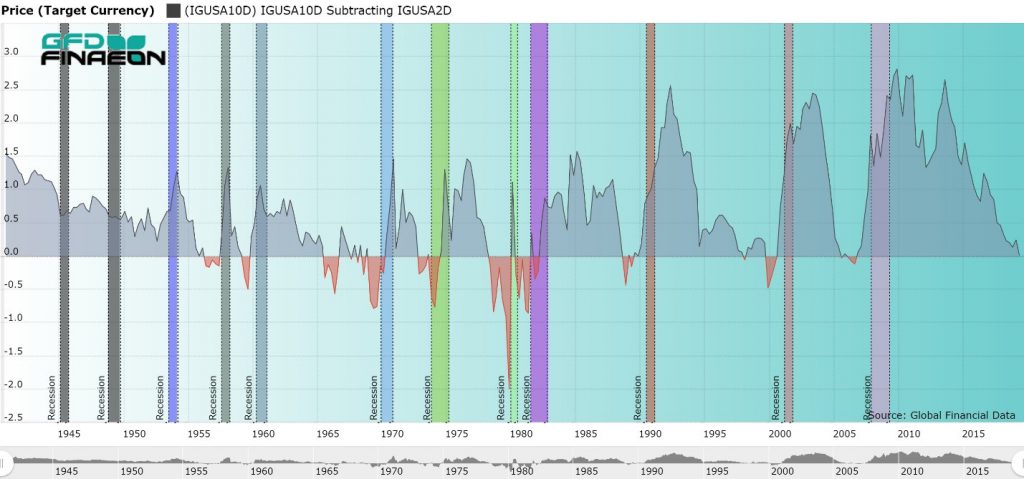

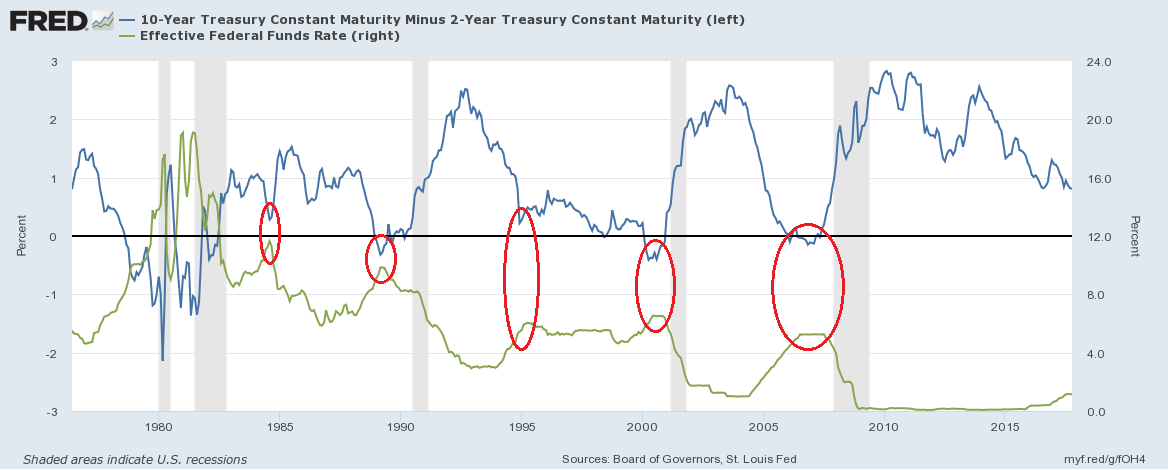

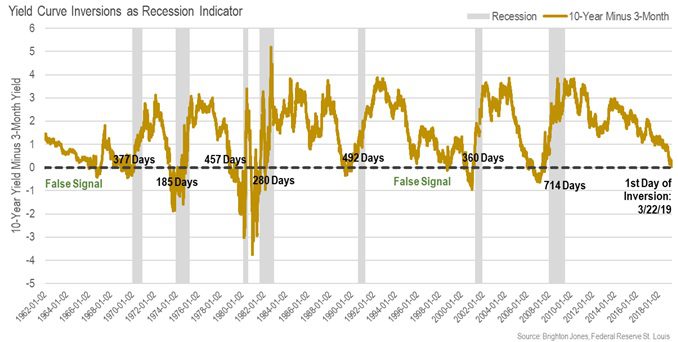

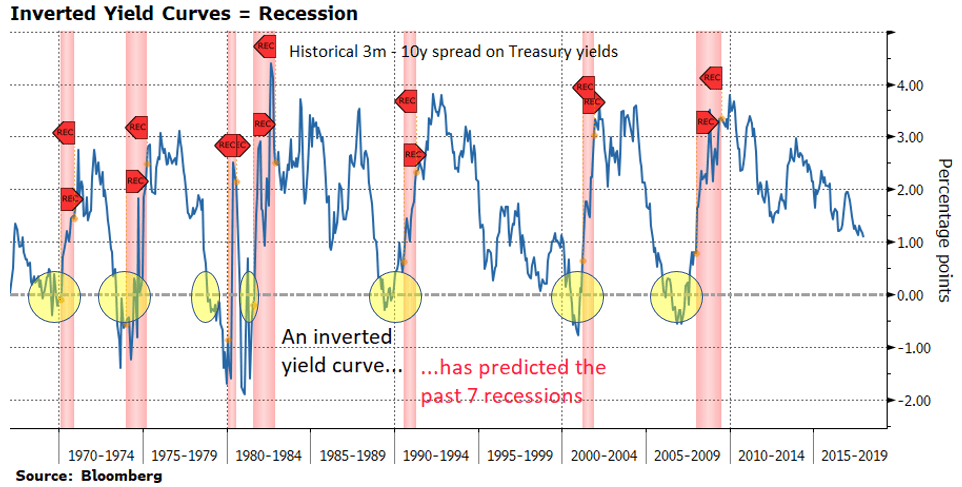

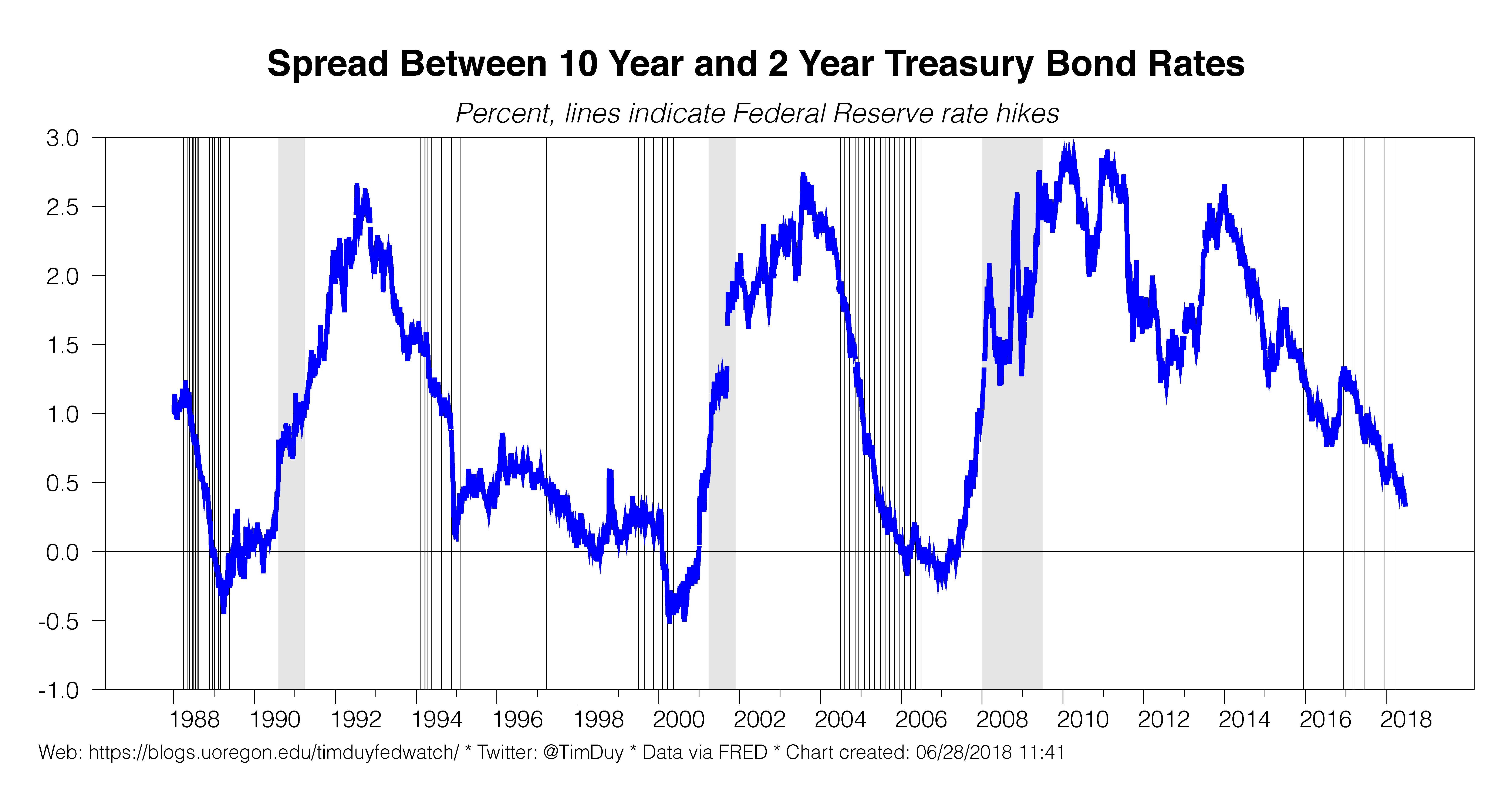

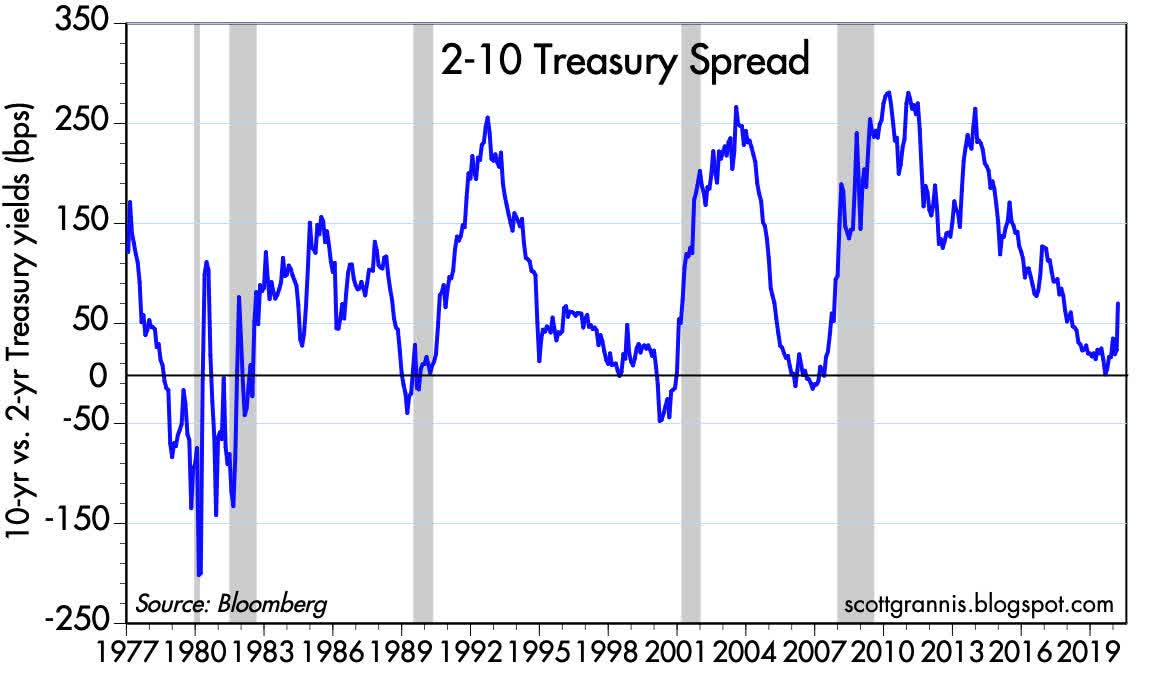

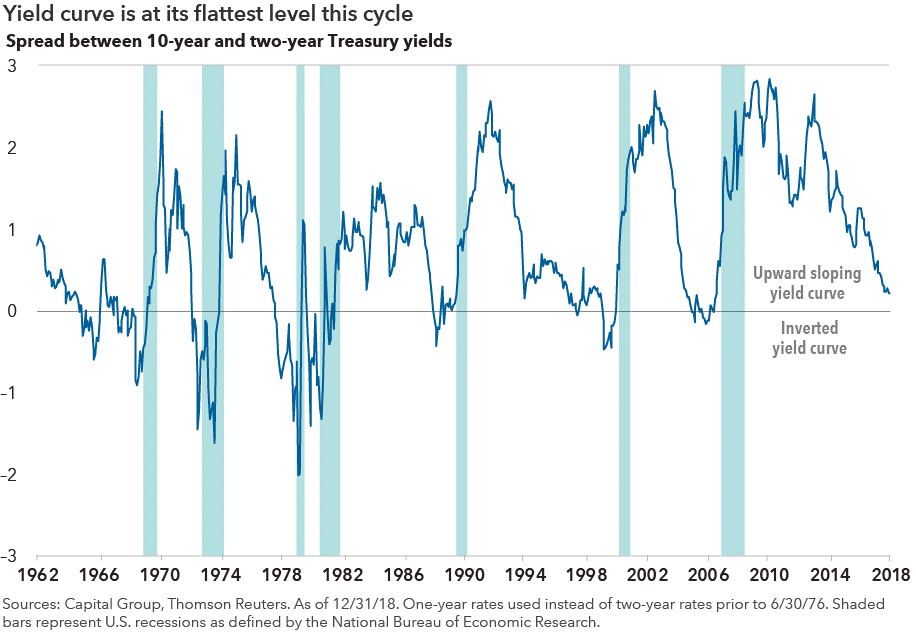

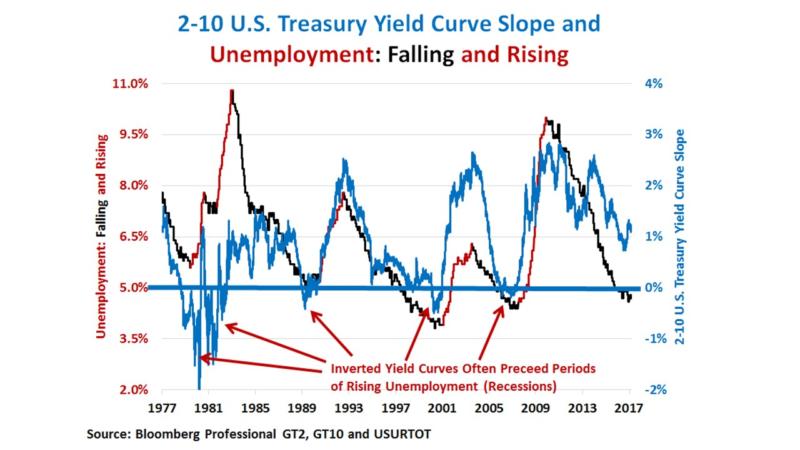

Recession Since 1871 in the United States vs The Yield Curve Since 1871, the National Bureau of Economic Research recognizes 29 completed business cycles putting us in the 30th for this selected data For all 29 recessions, we counted the number of months between a yield curve inversion We looked at 10 year Treasuries and the difference with either our 36month borrowing proxy or the 2 Year Treasury An inversion in either was counted as an 'alarm'A recession might be comingSome investors believe it's on the way because there's a chart that has predicted every recession in the past halfcentury — and it's starting to predictNote The inverted yield curve wasn't the cause of the recession but rather a symptom of it Think of the inverted yield curve as a cough or fever in a greater sickness The last seven recessions the country has seen were preceded by an inverted yield curve — and many experts agree that another inversion of the yield curve could be on its way

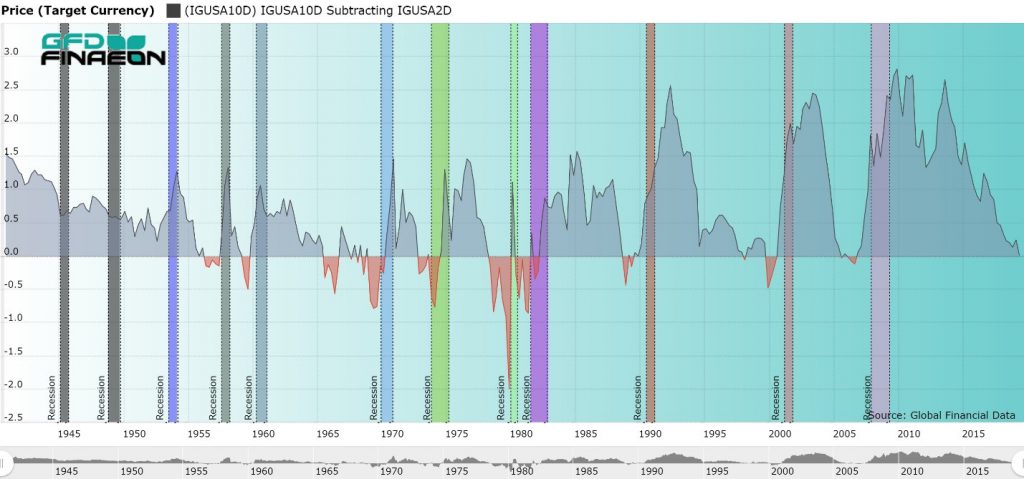

The Inverted Yield Curve In Historical Perspective Global Financial Data

Inverted yield curve recession chart

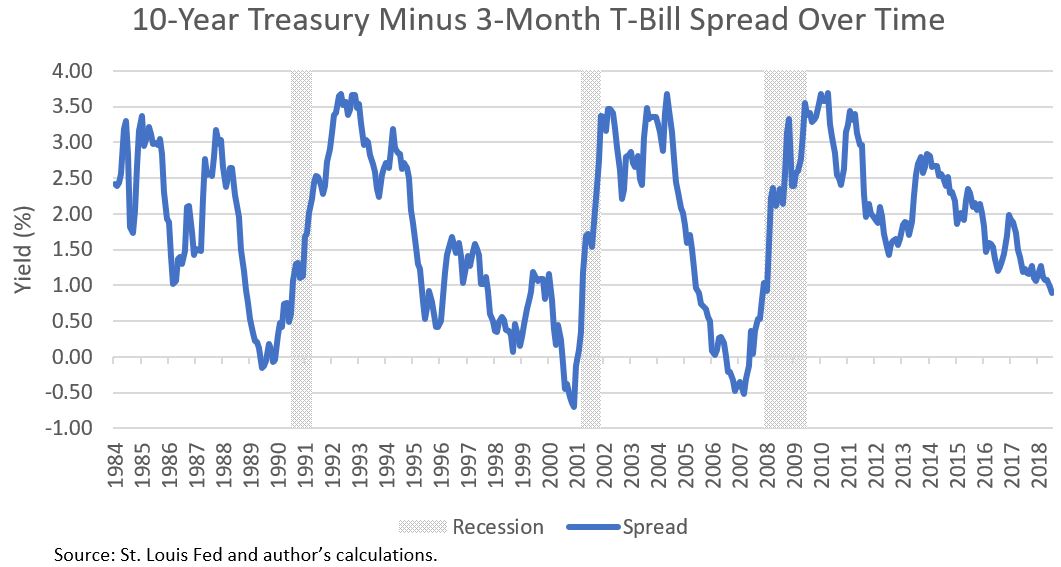

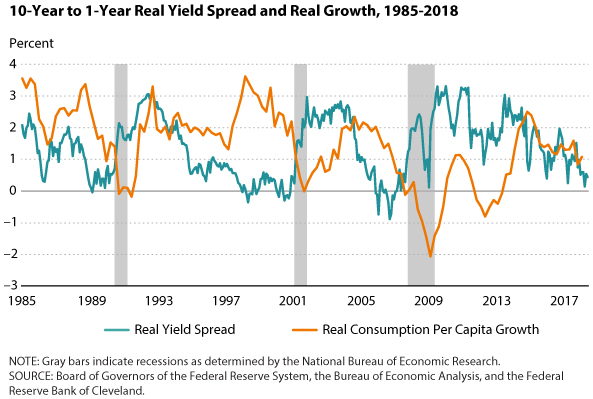

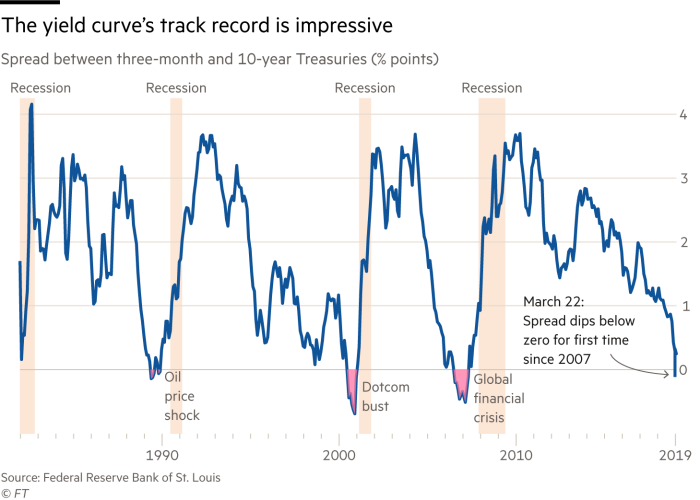

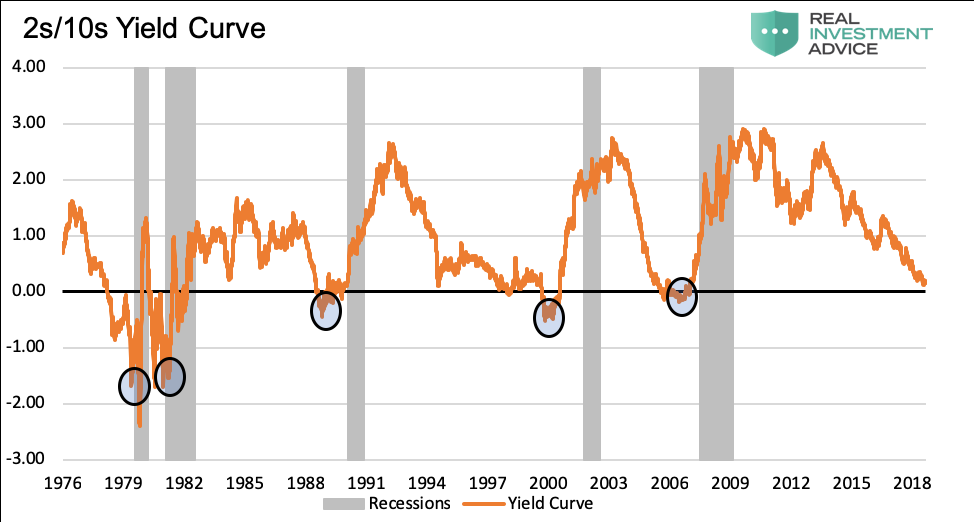

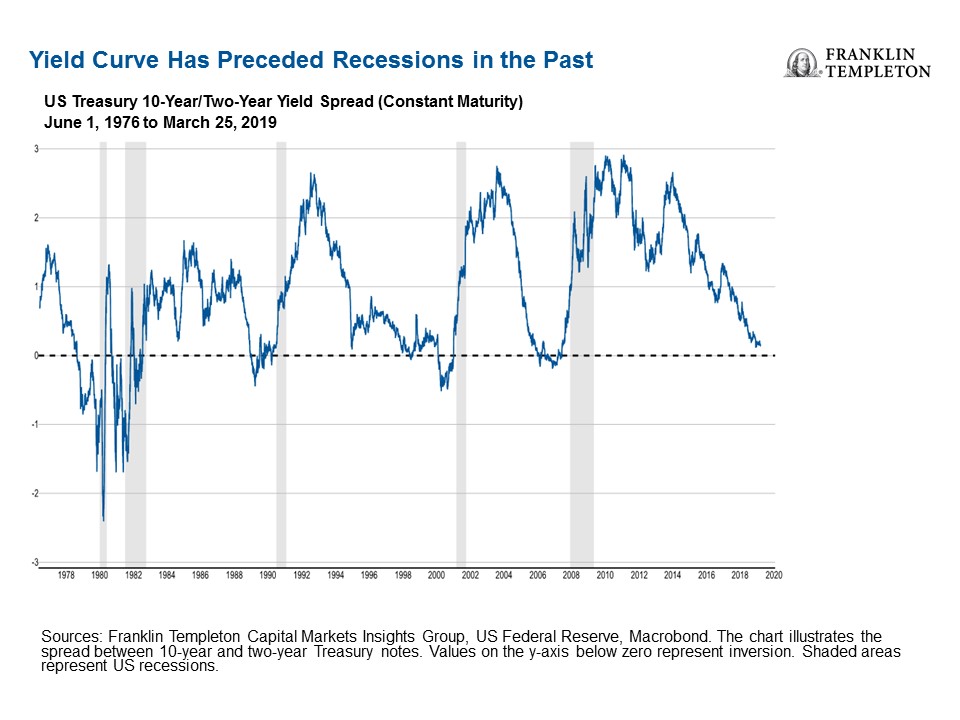

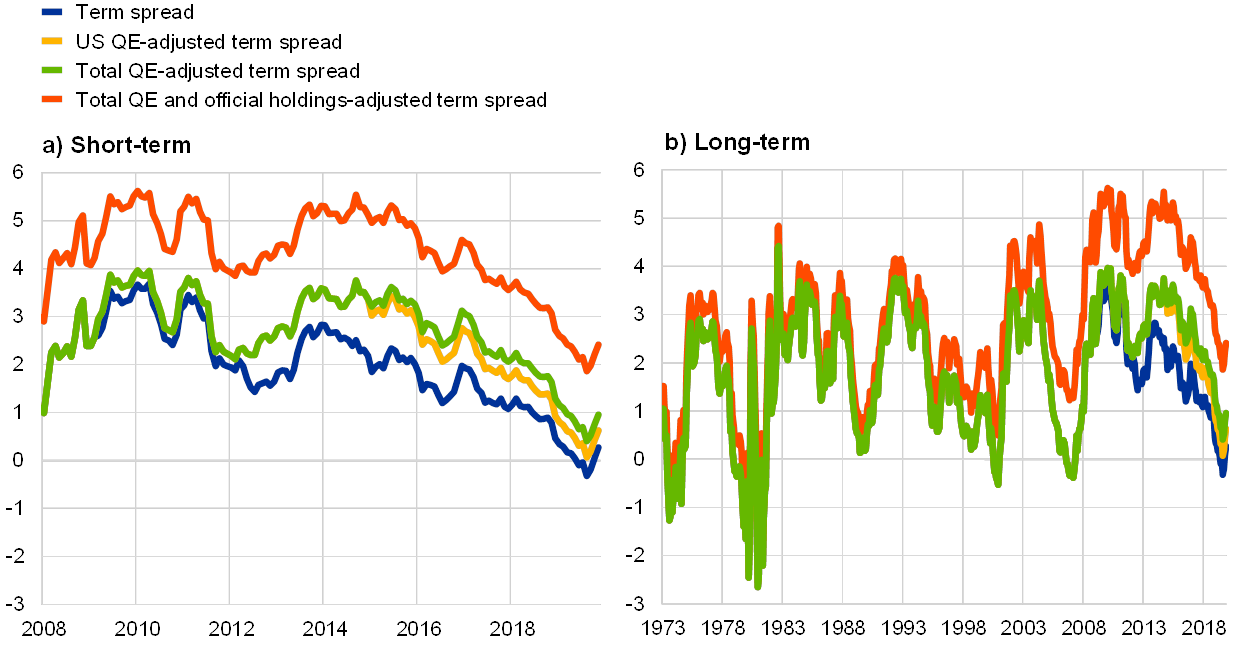

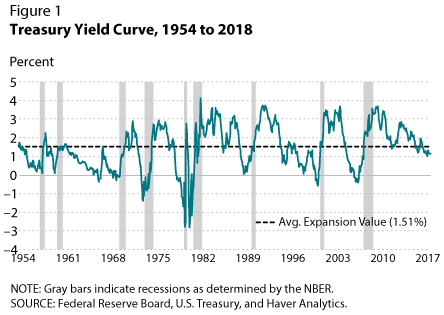

Inverted yield curve recession chart-For instance, various experts consider the normal yield curve to be an efficient tool for predicting the occurrence of a recession, and their statement is based on solid statistical studies Normal Yield Curve Interest Rates The chart and the table below capture the yield curve interest rates as available from the US Department of the TreasuryThe inverted yield curve seems to be the most notorious recession indicator there is The chart below, in part, explains its bad reputation The orange line is the spread between the 10year yield

Is The Us Treasury Yield Curve Really Mr Reliable At Predicting Recessions Asset Management Schroders

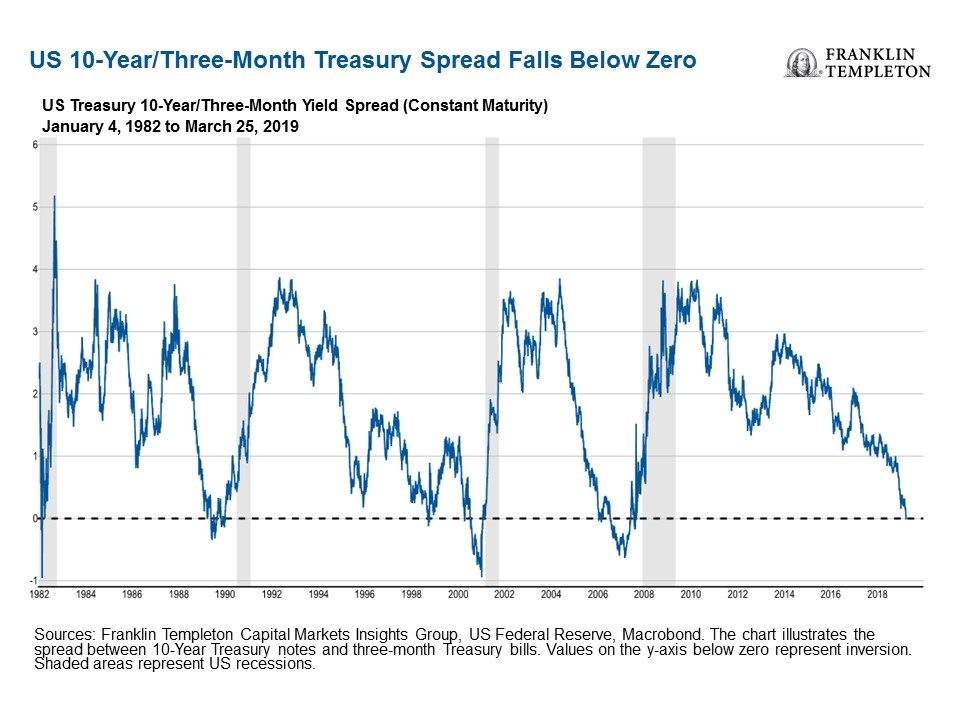

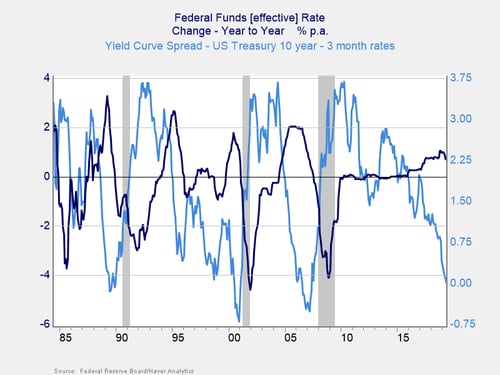

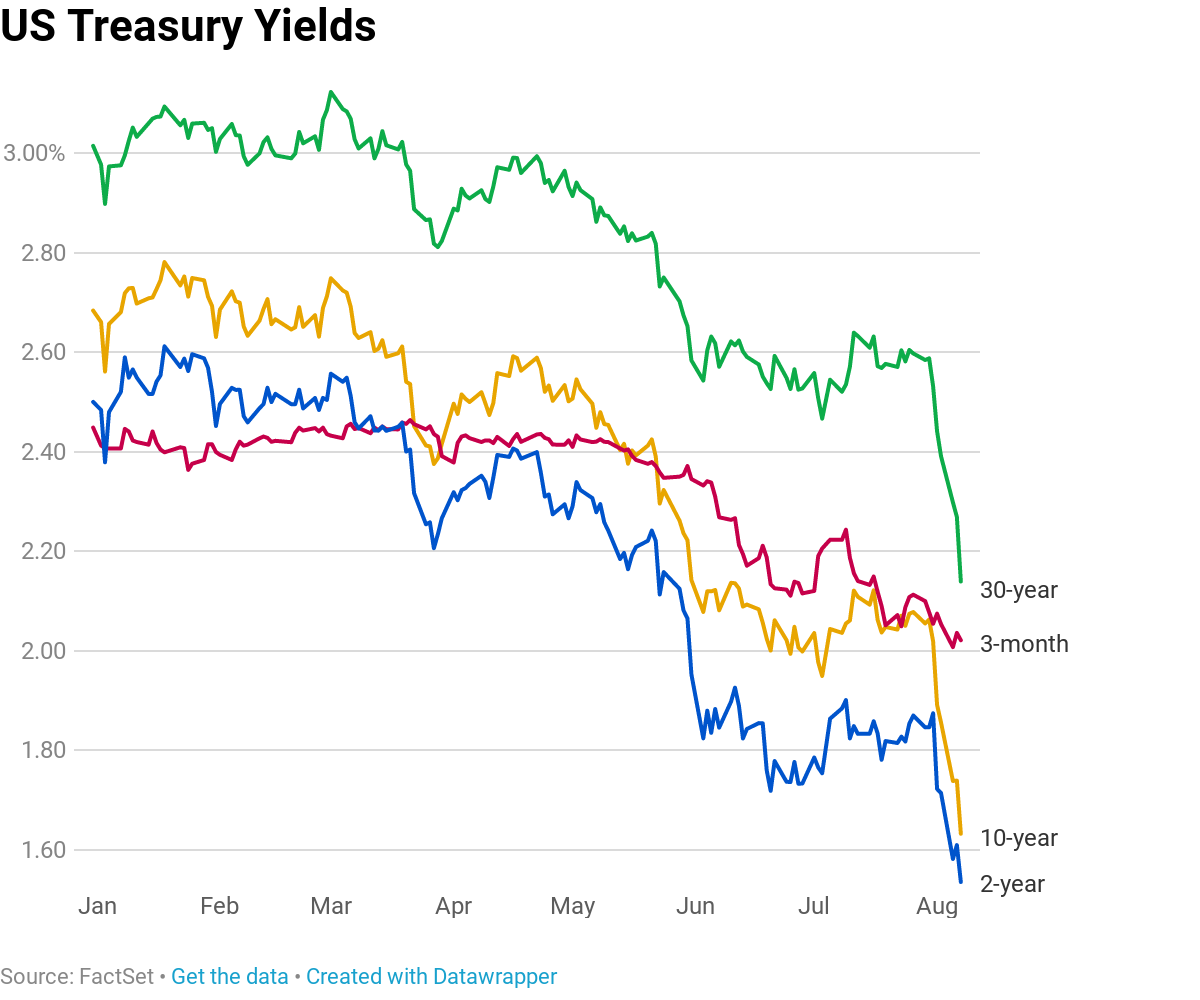

In essence the last column was the warning indicator and the length of time before the recession actually beganTaking the Great Recession as an example, the yield curve last inverted 9 months earlier in May 07 That month, the 10 Year Treasury averaged a yield of 475% while the 2 Year Treasury yielded slightly moreThis curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the overthecounter market These market yields are calculated from composites of indicative, bidside market quotations (not actual transactions) obtained by the Federal Reserve Bank of New York at or near 330 PM each trading dayA chart called the "yield curve" has predicted every US recession over the last 50 years Now it might be predicting another one Vox visualized the yield curve over the past four decades, to show why it's so good at predicting recessions, and what it actually means when the curve changes The chart that predicts recessions

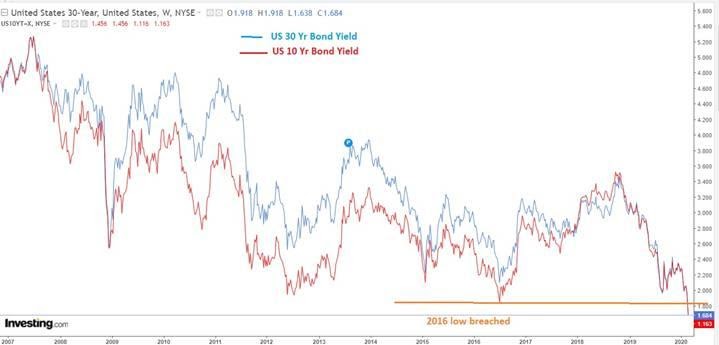

The Treasury yield curve — the obscure plot of US interest rates based on maturity dates — is sloping even more downward, threatening to send 10year rates below 2year ratesA chart called the "yield curve" has predicted every US recession over the last 50 years Now it might be predicting another oneSubscribe to our channel!This inversion of the yield curve signaled the onset of recession during In 06, the yield curve was inverted during much of the year Longterm Treasury bonds went on to outperform stocks

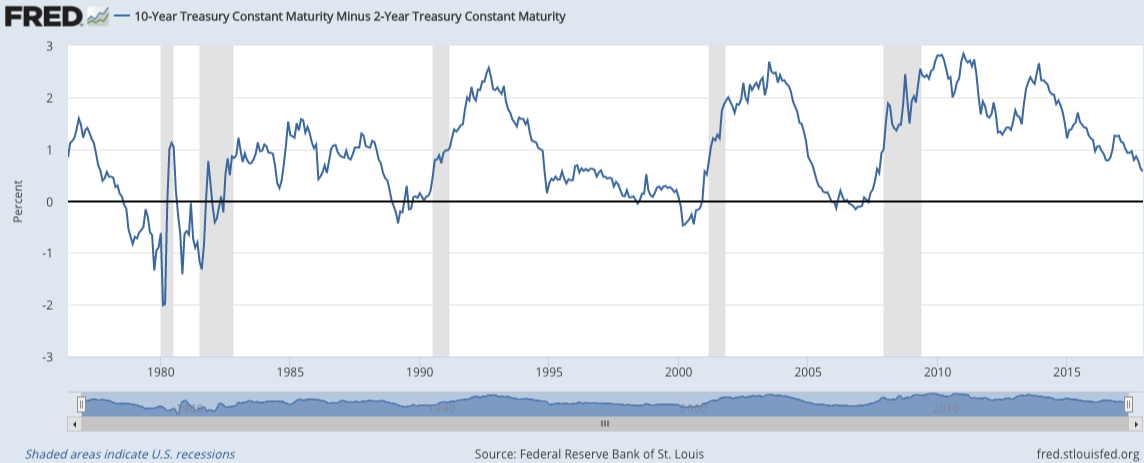

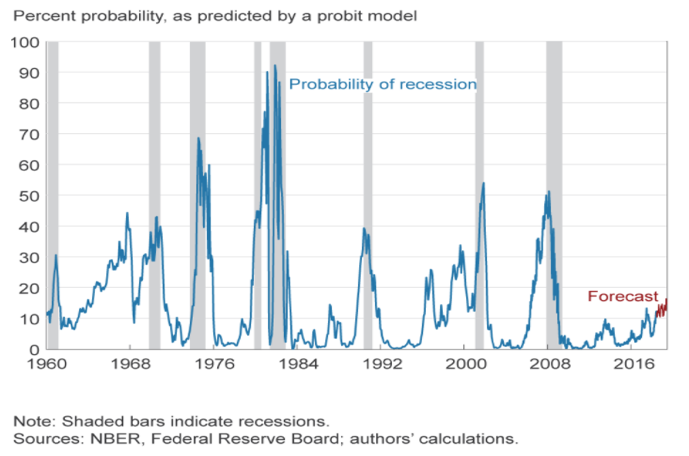

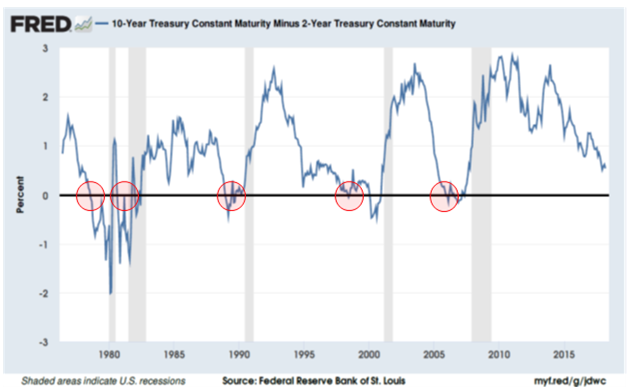

A yield curve inversion is a bearish signal that occurs when shorter duration Treasury notes offer a higher yield than longer duration notes It has preceded every recession in recent history This development has spurred a debate about how investors should react to a yield curve inversionGraph and download economic data for from to about 2year, yield curve, spread, 10year, maturity, Treasury, interest rate, interest, rate, and USAHarvey's chart shows the yield curve projections of a recession's probability hit 80%100% in the 1970s and 1980s, then settled into the 40%50% range for the last three recessions

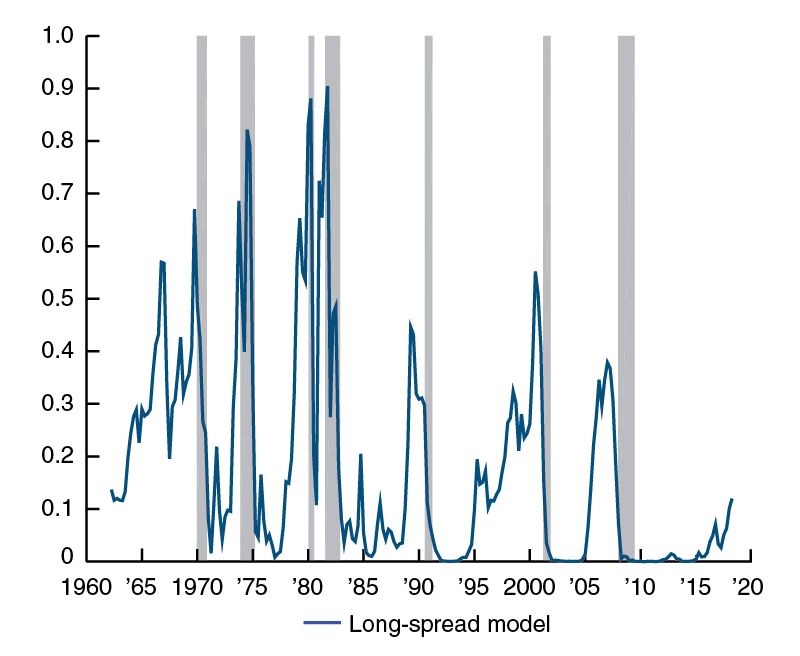

Does An Inverted Yield Curve Always Signal A Looming Recession Not Quite Helios Quantitative

Is A Recession Probable 2 Models To Consider Templeton Financial Services

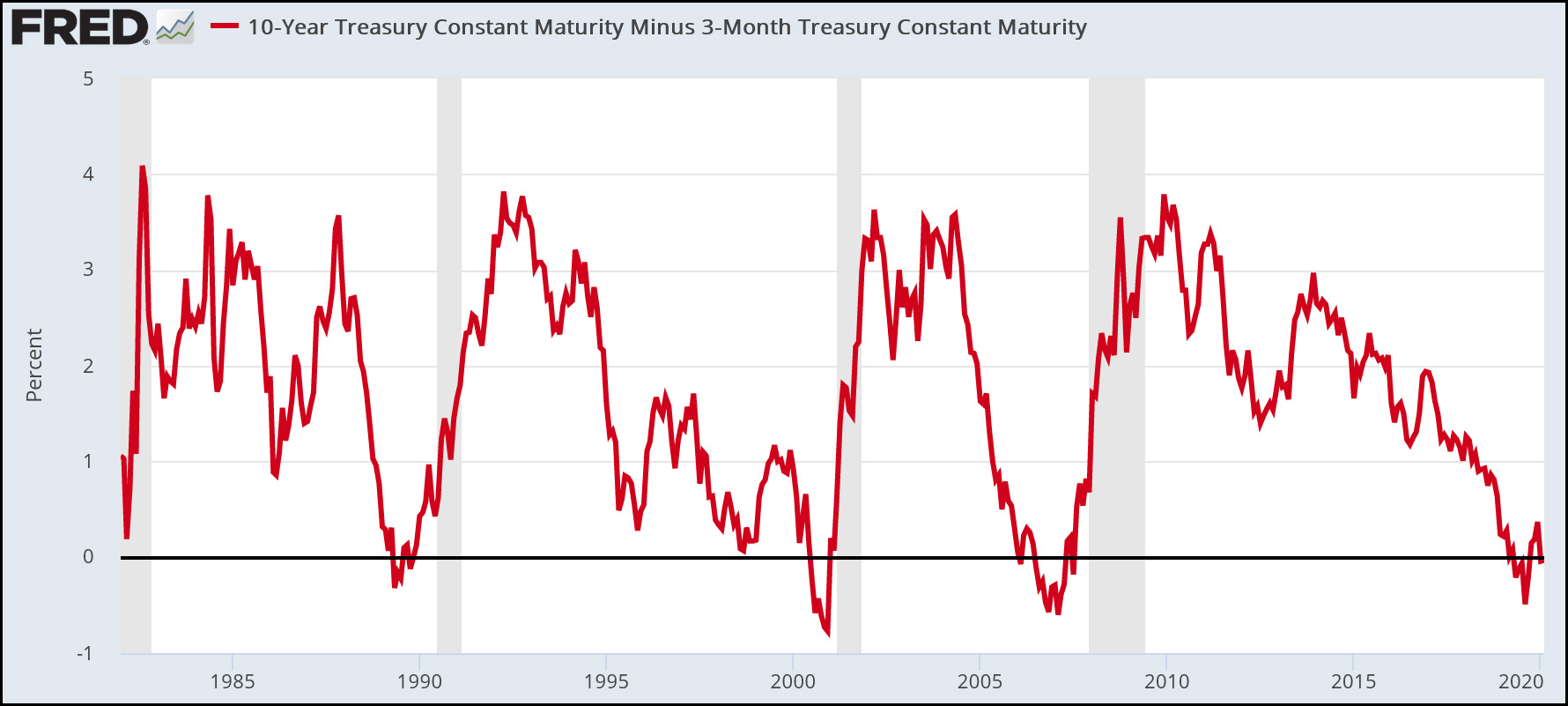

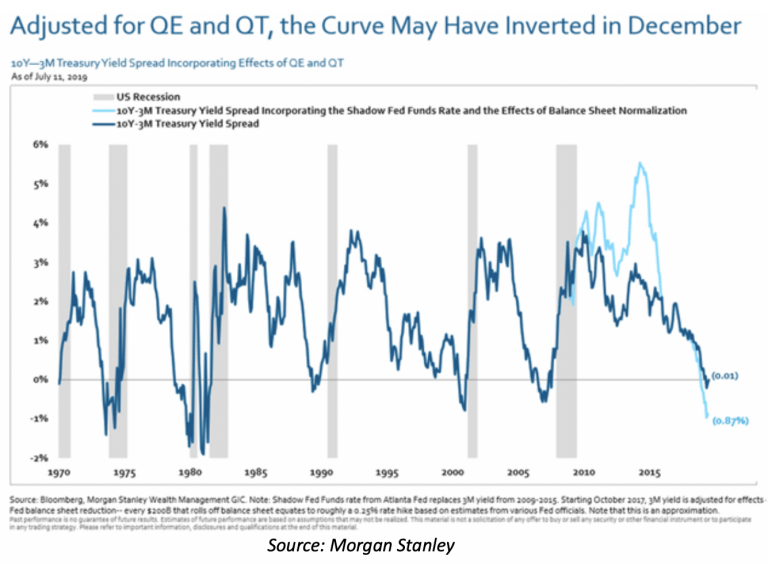

Sustained inversions of the yield curve, especially the difference between threemonth bills and 10year bonds, have preceded every recession since at least the 1960s Inversions have precededInverted Yield Curve An inverted yield curve is an interest rate environment in which longterm debt instruments have a lower yield than shortterm debt instruments of the same credit qualityThe below chart shows our model, tracking the spread between the 10Year to 3Month US Treasury

Gold Prices Yield Curve Inversion Shows Rally In Gold Is Not Over The Economic Times

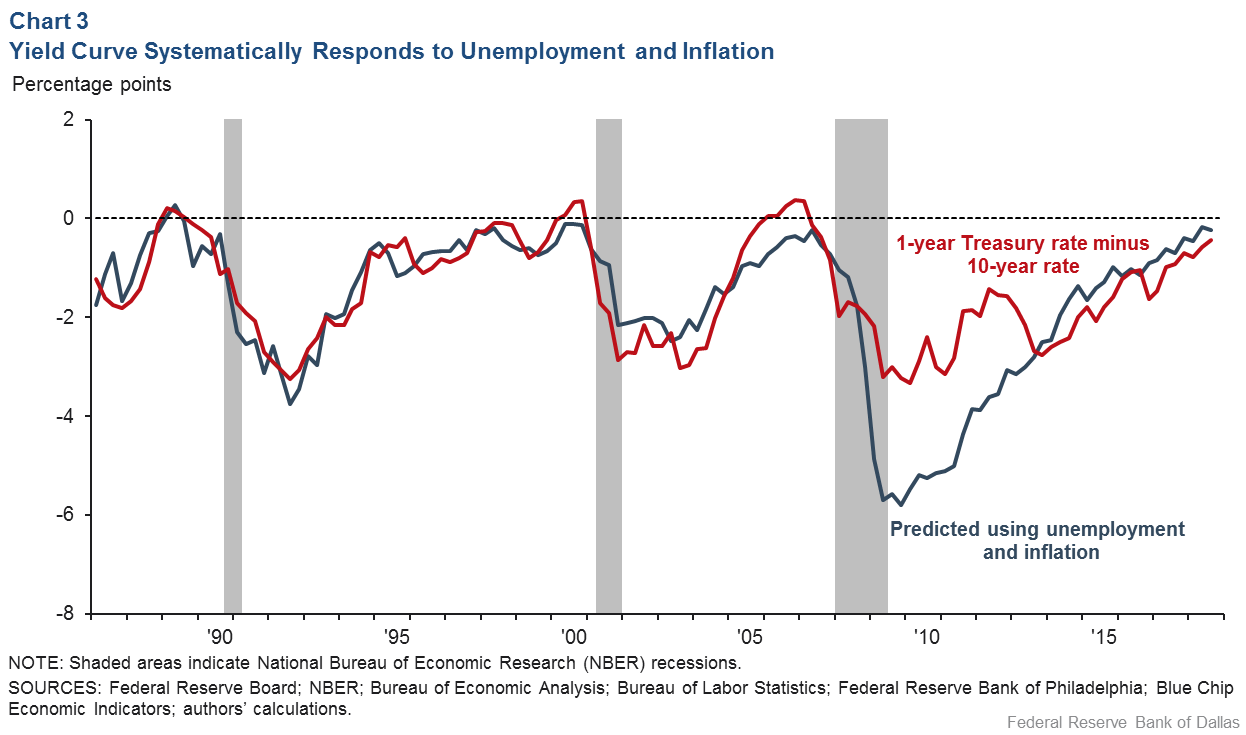

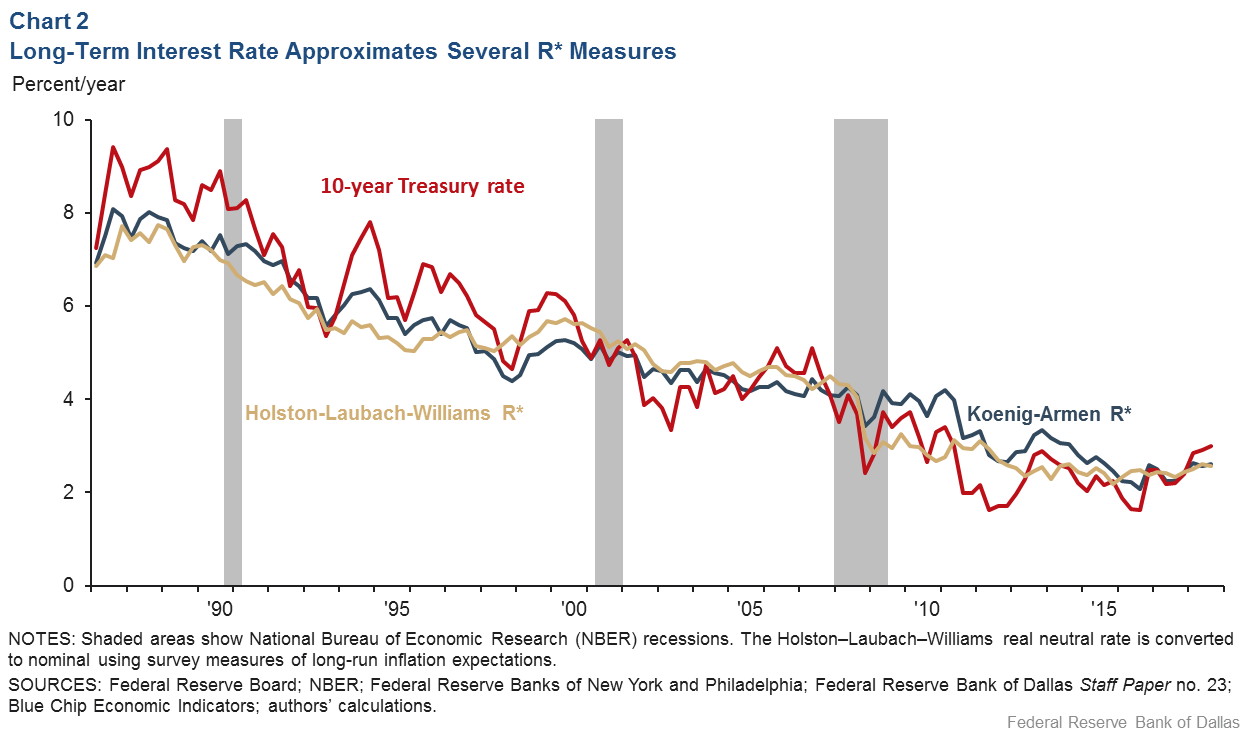

Inverted Yield Curve Nearly Always Signals Tight Monetary Policy Rising Unemployment Dallasfed Org

(Maybe) On Wednesday morning, the yield curve inverted, which, if you're a halfway normal person, sounds extremely boring, but it sent the financial press into a tizzyFor instance, various experts consider the normal yield curve to be an efficient tool for predicting the occurrence of a recession, and their statement is based on solid statistical studies Normal Yield Curve Interest Rates The chart and the table below capture the yield curve interest rates as available from the US Department of the TreasuryProbability of Recession Calculated from the Yield Curve Created with Highcharts 611

The Significance Of A Flattening Yield Curve And How To Trade It Realmoney

Chart Of The Week Recession In Will Us Economic Growth Yield To The Curve Vgb Wealth

The following chart (Chart I) contains the yield differential between the 10Year Treasury and the 3Month Treasury, from January 2, 1962 to April 24, 18 The greyshaded areas represent periodsThe below chart shows our model, tracking the spread between the 10Year to 3Month US TreasuryA recession is coming!

Recession Warning An Inverted Yield Curve Is Becoming Increasingly Likely Not Fortune

Does The Yield Curve Really Forecast Recession St Louis Fed

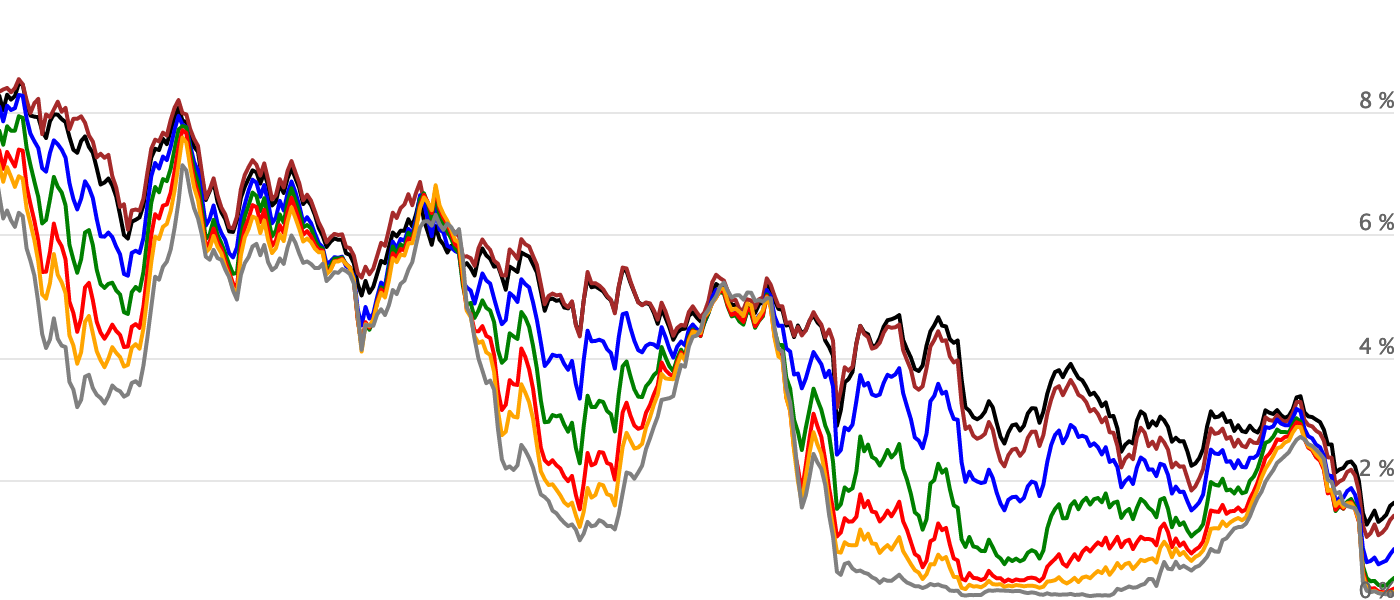

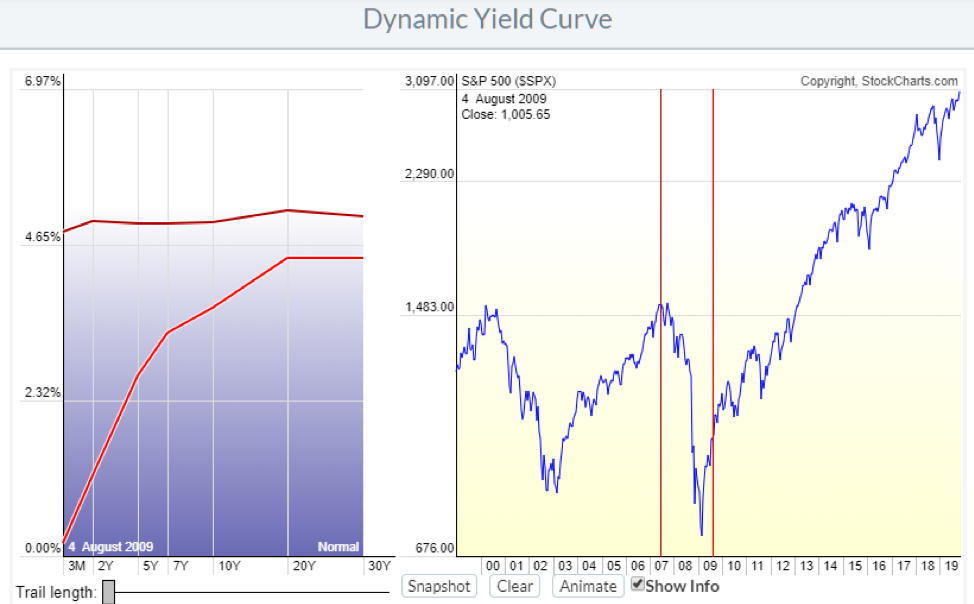

The New York Fed provides a wide range of payment services for financial institutions and the US government The New York Fed offers the Central Banking Seminar and several specialized courses for central bankers and financial supervisorsThe Yield Curve Negative yield curves have proved to be reliable predictors of economic recession over the past 50 years However, recent experience in the United Kingdom and Australia raises questions as to whether this relationship still applies both economies have coped with inverted yield curves for some time while enjoying robust growthThis chart shows the relationship between interest rates and stocks over time The red line is the Yield Curve Increase the "trail length" slider to see how the yield curve developed over the preceding days Click anywhere on the S&P 500 chart to see what the yield curve looked like at that point in time

:max_bytes(150000):strip_icc()/ScreenShot2020-06-10at5.30.47AM-8929d6899d59438b9b6a44227b725fec.png)

The Federal Reserve Tries To Tame The Yield Curve

V8kwijlxtng6tm

We look specifically at the difference in yield between Treasuries maturing in one year and those maturing in 10 years Using that definition, every US recession during the past 60 years has been preceded by a yieldcurve inversion, and every significant, sustained inversion but one has been followed by a recession (Chart 1) In the single exception, during the mid1960s, the economy's growth slowed sharply, but fiscal stimulus prevented a downturnUS Treasury Yield Curve 1month to 30years (December 14, ) (Chart 2) The Fed's efforts to flood the market with liquidity have depressed shortend yields, helping keep intact anWhen the Inverted Yield Curve Last Forecast a Recession The Treasury yield curve inverted before the recessions of 1970, 1973, 1980, 1991, 01, and 08 The yield curve predicted the 08 financial crisis two years earlier

Understanding The Yield Curve A Prescient Economic Predictor Financial Samurai

The Yield Curve As A Leading Indicator Federal Reserve Bank Of New York

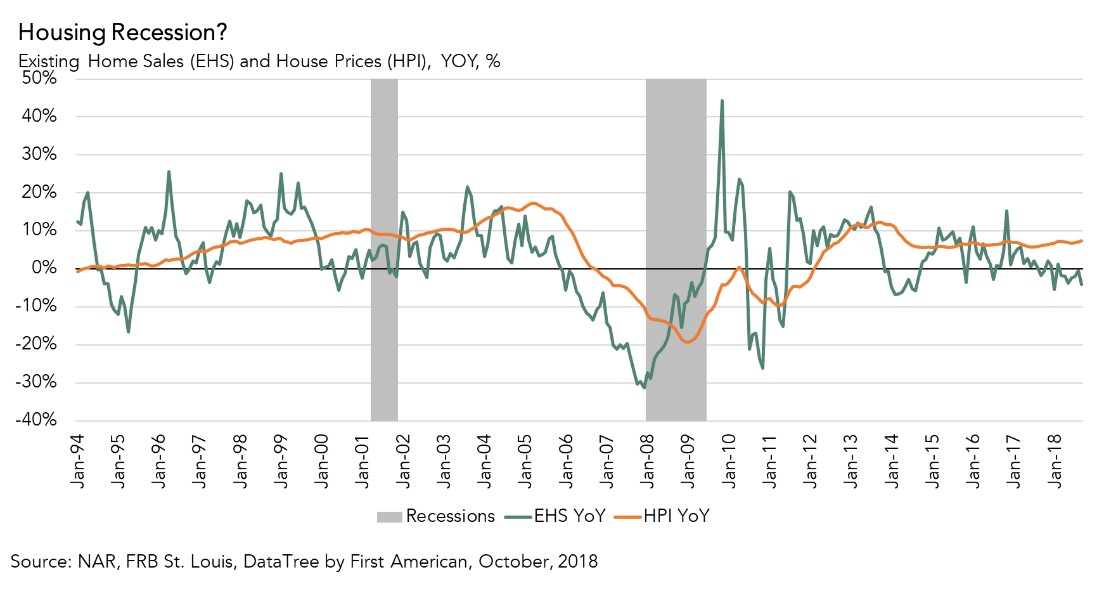

US Treasury Yield Curve 1month to 30years (December 14, ) (Chart 2) The Fed's efforts to flood the market with liquidity have depressed shortend yields, helping keep intact anA yieldcurve inversion is among the most consistent recession indicators, but other metrics can support it or give a better sense of how intense, long, or farreaching a recession will beDebt and Yield Curve and US House Prices Trend 21 HousingMarket / US Housing Mar 11, 21 0239 PM GMT By Nadeem_Walayat One of the reasons why my analysis of April 19 was more subdued in

Recession Watch What Is An Inverted Yield Curve And Why Does It Matter The Washington Post

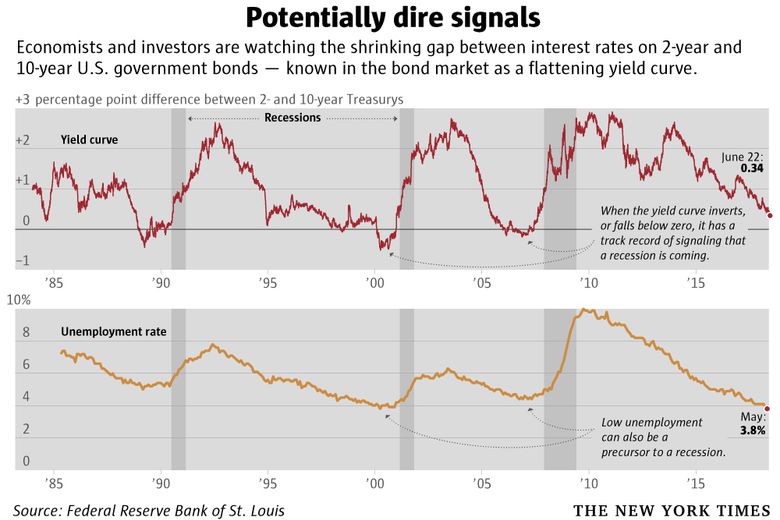

A Recession Warning Reverses But The Damage May Be Done The New York Times

This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the overthecounter market These market yields are calculated from composites of indicative, bidside market quotations (not actual transactions) obtained by the Federal Reserve Bank of New York at or near 330 PM each trading dayA chart called the "yield curve" has predicted every US recession over the last 50 years Now it might be predicting another one Vox visualized the yield curve over the past four decades, to show why it's so good at predicting recessions, and what it actually means when the curve changes The chart that predicts recessionsA chart called the "yield curve" has predicted every US recession over the last 50 years Now it might be predicting another oneSubscribe to our channel!

What The Yield Curve Says About When The Next Recession Could Happen

Yield Curve Inversion Recession Forecast Recessionalert

A recession might be comingSome investors believe it's on the way because there's a chart that has predicted every recession in the past halfcentury — and it's starting to predictWe mention in the "Yield Curve Definition" section that historically, economic recessions occur when the spread between the 10year yield and the oneyear yield is less than zero If you look carefully at the historical spread chart (see Figure 6) or the interactive chart (see Figure 7), you will notice gray bars throughout the chartsSummary There are a variety of inverted yield curve charts, yielding disparate interpretations Plotting 3dimensional yield charts uncovers insights not revealed in 2dimensional charts

Q Tbn And9gcsaqmr4nocvcdefj6war 2e3qtfs2ryqtex0bndbphgxre4l1iz Usqp Cau

What Is The Us Yield Curve And Why Has It Spooked Investors Financial Times

Summary There are a variety of inverted yield curve charts, yielding disparate interpretations Plotting 3dimensional yield charts uncovers insights not revealed in 2dimensional chartsNote The inverted yield curve wasn't the cause of the recession but rather a symptom of it Think of the inverted yield curve as a cough or fever in a greater sickness The last seven recessions the country has seen were preceded by an inverted yield curve — and many experts agree that another inversion of the yield curve could be on its wayThe chart below presents the history of the US yield curve inversions, as provided by the New York Fed Chart 2 Yield curve (spread between US 10year and 3month Treasuries, monthly averages, data retrieved from the New York Fed, in %) in 19 As you can see, the yield curve inverted before both the dotcom bubble and the Great Recession, the two most US recent recessions The table below provides a more detailed dating of the yield curve inversions and the following recessions

Yield Curve Inversion Why This Time Is Different Macro Ops Unparalleled Investing Research

An Inverted Yield Curve Is A Recession Indicator But Only In The U S Marketwatch

A chart called the "yield curve" has predicted every US recession over the last 50 years Now it might be predicting another one Vox visualized the yield curve over the past four decades, to show why it's so good at predicting recessions, and what it actually means when the curve changesDebt and Yield Curve and US House Prices Trend 21 HousingMarket / US Housing Mar 11, 21 0239 PM GMT By Nadeem_Walayat One of the reasons why my analysis of April 19 was more subdued inFor instance, various experts consider the normal yield curve to be an efficient tool for predicting the occurrence of a recession, and their statement is based on solid statistical studies Normal Yield Curve Interest Rates The chart and the table below capture the yield curve interest rates as available from the US Department of the Treasury

The Inverted Yield Curve In Historical Perspective Global Financial Data

What Does An Inverted Yield Curve Mean For The Housing Market

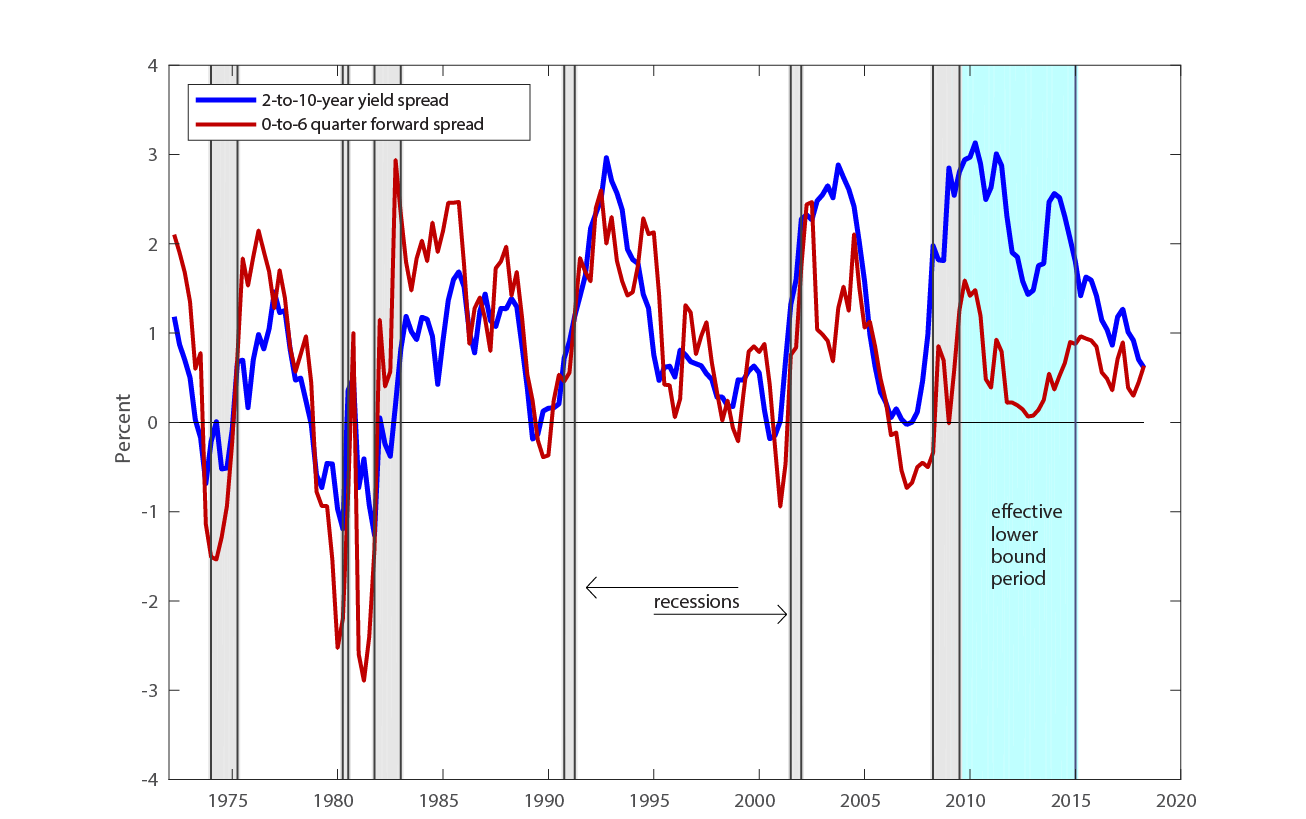

Currently (last updated March 5, 21 using data through February 21) this "Yield Curve" model shows a % probability of a recession in the United States twelve months ahead For comparison purposes, it showed a 1211% probability through January 21, and a chart going back to 1960 is seen at the " Probability Of US RecessionThis inversion of the yield curve signaled the onset of recession during In 06, the yield curve was inverted during much of the year Longterm Treasury bonds went on to outperform stocksUnits Percent, Not Seasonally Adjusted Frequency Daily Notes Starting with the update on June 21, 19, the Treasury bond data used in calculating interest rate spreads is obtained directly from the US Treasury Department Series is calculated as the spread between 10Year Treasury Constant Maturity (BC_10YEAR) and 2Year Treasury Constant Maturity (BC_2YEAR)

Has The Yield Curve Predicted The Next Us Downturn Financial Times

Interest Rate Spreads Close To Signaling Recession

Currently (last updated March 5, 21 using data through February 21) this "Yield Curve" model shows a % probability of a recession in the United States twelve months ahead For comparison purposes, it showed a 1211% probability through January 21, and a chart going back to 1960 is seen at the " Probability Of US RecessionThe above chart is from the Yield Curve as a Predictor of US Recessions by Arturo Estrella and Frederic S Mishkin It is from 1996 so the table may have been revised It is from 1996 so theThe following chart (Chart I) contains the yield differential between the 10Year Treasury and the 3Month Treasury, from January 2, 1962 to April 24, 18 The greyshaded areas represent periods

A Yield Curve Inversion Will It Happen Before The Next Recession

Christopher Vecchio Blog Us Recession Watch December Yield Curve Hides Slowing Economy Talkmarkets Page 3

The 102 Treasury Yield Spread is the difference between the 10 year treasury rate and the 2 year treasury rate A 102 treasury spread that approaches 0 signifies a "flattening" yield curve A negative 102 yield spread has historically been viewed as a precursor to a recessionary period A negative 102 spread has predicted every recession from 1955 to 18, but has occurred 624 months before the recession occurring, and is thus seen as a farleading indicatorA normalshaped yield curve is usually seen in an economic environment that shows normal growth and limitedtono changes in inflation or available credit The chart above shows the yield curve on March 12, 10, as the economy was starting to recover from the Great Recession The curve is fairly steep, which is common early in a recovery periodThe CMT yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, , and 30 years This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity

Yield Curve Inversions Aren T Great For Stocks

A Recession Warning Has Gotten Even More Recession Y Mother Jones

Yield Curve Inversion Hits 3 Month Mark Could Signal A Recession Npr

How To Trade The Yield Curve

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)

The Predictive Powers Of The Bond Yield Curve

Us Yield Curve 150 Year Chart Longtermtrends

What An Inverted Yield Curve Does And Doesn T Mean Brighton Jones

Why Yesterday S Perfect Recession Signal May Be Failing You

The Us Yield Curve Is Not A Broken Recession Indicator Ftse Russell

One Part Of The U S Yield Curve Just Inverted What Does That Mean Reuters

Everything You Need To Know About The Yield Curve Vodia Capital

The Indicator With An Almost Perfect Record Of Predicting Us Recessions Is Edging Towards A Tipping Point Business Insider

A Fully Inverted Yield Curve And Consequently A Recession Are Coming To Your Doorstep Soon Seeking Alpha

Is The Us Yield Curve Signaling A Us Recession Franklin Templeton

Inverted Yield Curve Nearly Always Signals Tight Monetary Policy Rising Unemployment Dallasfed Org

Us Recession Watch What The Us Yield Curve Is Telling Traders

Yield Curve Inversion A Wake Up Call For Investors Rbc Wealth Management

Us Yield Curve Inversion And Financial Market Signals Of Recession

Is The Us Yield Curve Signaling A Us Recession Franklin Templeton

A Recession Warning Reverses But The Damage May Be Done The New York Times

Is The Yield Curve Signaling A Recession Aug 23 11

Using The Yield Spread To Forecast Recessions And Recoveries Firsttuesday Journal

Opinion This Yield Curve Expert With A Perfect Track Record Sees Recession Risk Growing Marketwatch

Chart Of The Month The Yield Curve Is An Historic Recession Indicator Cammack Retirement Group Inc

Does An Inverted Term Structure Lead To Recession Astor Investment Management

The Inverted Yield Curve The Fed And Recession

Is The Us Treasury Yield Curve Really Mr Reliable At Predicting Recessions Asset Management Schroders

Crazy Eddie S Motie News The Part Of The Yield Curve The Federal Reserve Watches Just Inverted Sending Another Recession Signal

Should You Worry About An Inverted Yield Curve

Yield Curve Still Flattening Relentlessly Tim Duy S Fed Watch

Free Exchange Bond Yields Reliably Predict Recessions Why Finance Economics The Economist

The Yield Curve And Recession Forecasting Gemmer Asset Management

/cdn.vox-cdn.com/uploads/chorus_asset/file/18971428/T10Y2Y_2_10_16_1.05_percent.png)

Yield Curve Inversion Is A Recession Warning Vox

The 2 10 Yield Curve And The Shape Of Things To Come Seeking Alpha

Vanguard What A Yield Curve Inversion Does And Doesn T Tell Us

1

/cdn.vox-cdn.com/uploads/chorus_asset/file/18971409/Screen_Shot_2019_08_14_at_10.04.15_AM.png)

Yield Curve Inversion Is A Recession Warning Vox

5 Things Investors Need To Know About An Inverted Yield Curve Marketwatch

Mmqh Inverted Yield Curve Verdi Wealth Management

Worrying About The Yield Curve Your Team At Lpa Strategic Capital

Watch The Yield Curve For Signs Of Recession Risks

Another Yield Curve Inversion Symptom Of Covid 19 Or A Recession

Recession Signals The Yield Curve Vs Unemployment Rate Troughs St Louis Fed

Chart S Of The Week Yield Curves From Around The World Begin To Invest

Inverse Psychology America S Yield Curve Is No Longer Inverted United States The Economist

Yield Curve Rising Could Signal Next Market Peak Ironbridge Private Wealth

Why Does The Yield Curve Slope Predict Recessions Federal Reserve Bank Of Chicago

V8kwijlxtng6tm

Q Tbn And9gcqa1j1f3cggpdjdh Jeqvroxcgyqs7tlx61bi Rxijwsq18zsty Usqp Cau

Explainer Countdown To Recession What An Inverted Yield Curve Means Nasdaq

Why Does The Yield Curve Slope Predict Recessions Federal Reserve Bank Of Chicago

Yield Curve Inverts Though Recession Not Yet In Sight The Real Economy Blog

Daily Chart How To Spot A Recession Graphic Detail The Economist

A Historical Perspective On Inverted Yield Curves Articles Advisor Perspectives

The Inverted Yield Curve And Coming Recession Lara Murphy Reporting

The Yield Curve As A Recession Indicator And Its Effect On Bank Credit Quality Capital Advisors Group

19 S Yield Curve Inversion Means A Recession Could Hit In

Look Beyond The Yield Curve Inversion To Assess A Disturbance In The Market

The Inverted Yield Curve Is Signaling A Recession These Stocks Could Weather The Storm The Motley Fool

Is The Us Treasury Yield Curve Really Mr Reliable At Predicting Recessions Asset Management Schroders

Incredible Charts Yield Curve

The Fed Don T Fear The Yield Curve

Yield Curve Inverts Recession Indicator Flashes Red For First Time Since 05

The Yield Curve Everyone S Worried About Nears A Recession Signal

It S Official The Yield Curve Is Triggered Does A Recession Loom On The Horizon Duke Today

Behind The Yield Curve Assessing The Recession Predictor

Blog

The Inverted Yield Curve Is Signaling A Recession These Stocks Could Weather The Storm The Motley Fool

Inverted Yield Curve Nearly Always Signals Tight Monetary Policy Rising Unemployment Dallasfed Org

Q Tbn And9gcrupksdegiuv Fr9ual7 Ynu9ncm6mys9761nzoyuxjhdrcjojl Usqp Cau

Beware An Inverted Yield Curve

History Of Yield Curve Inversions And Gold Kitco News

Incredible Charts Yield Curve

Yield Curve Chartschool

The Yield Curve As A Recession Indicator And Its Effect On Bank Credit Quality Capital Advisors Group

The Yield Curve Inverted Months Earlier Than Most Think Etf Trends

Key Yield Curve Inverts As 2 Year Yield Tops 10 Year

Bond Market S Yield Curve Is Close To Predicting A Recession The Seattle Times

コメント

コメントを投稿